Beneficiaries – Per Stirpes or Per Capita?

February 28, 2022

Written by: Wendy Lange | February 28, 2022

Did you know the paperwork you complete to name beneficiaries on IRA’s, brokerage accounts, annuities, and life insurance will trump your will or trust wishes? Surprisingly, many people are unaware of this. All too often, we see new clients with outdated beneficiary designations – examples include ex-spouses, deceased relatives, etc. It is extremely important that you have the correct beneficiaries on each of these accounts. No one wants to have an asset pass through probate from forgetting a simple beneficiary election. That hard earned money deserves to remain in your family, not with lawyers and government officials!

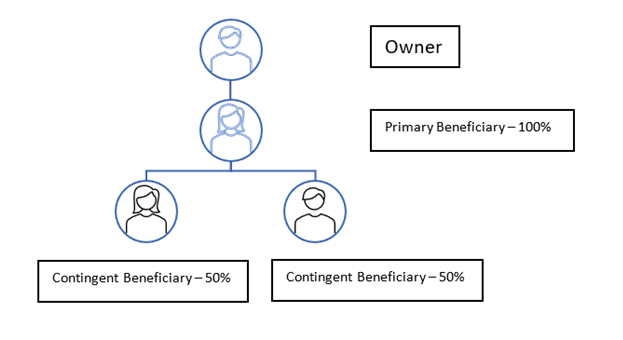

There are two types of beneficiaries, primary and contingent. A primary is your first choice, and a contingent is who would receive the funds in the event your primary beneficiary is already deceased or deceased at the same time as you, the account owner. You may have more than one primary beneficiary – the 100% account value “pie” can be divvied up how you see fit.

Per Stirpes vs. Per Capita

What happens if one of your beneficiaries predeceases you? Do you want the funds to be split amongst the surviving beneficiaries equally or do you want it to pass to your deceased beneficiaries’ descendants (often grandchildren)?

Per stirpes is a Latin phrase that translates literally to “by roots” or “by branch.” This designates that your monies will pass down the blood line. This comes into play commonly with grandchildren and wanting to ensure that they receive an equal percentage of your estate.

Here’s an example:

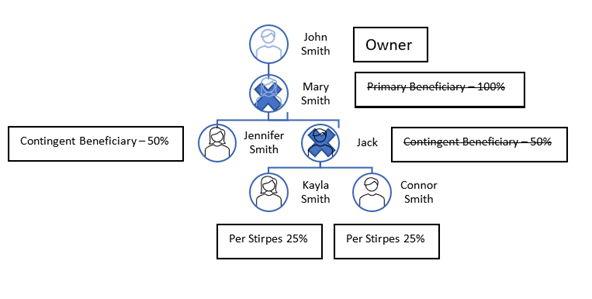

John and Mary Smith have two children, Jennifer and Jack. On their asset accounts they have each other listed as primary beneficiaries and then Jennifer and Jack as contingent per stirpes beneficiaries. Here’s what that looks like:

Mary Smith passed away. This leaves Jennifer and Jack as the beneficiaries. Two weeks after Mary passed away, Jack was killed in an accident. When John Smith passes away, this is what that situation would look like:

As you see from the example above, per stirpes passes down through the bloodline to Jack’s children (John’s grandchildren).

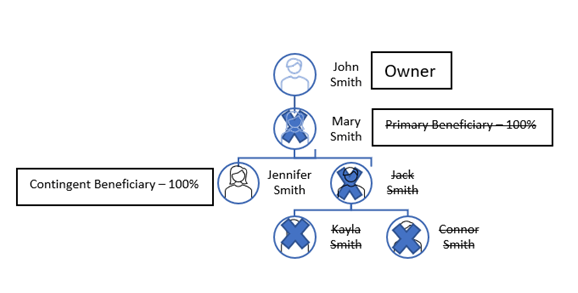

If you do not designate a beneficiary as “per stirpes,” the funds will be split evenly among the remaining primary beneficiaries, known commonly as “per capita.” Per capita is a Latin term that translates literally to “by head.” This is what per capita would look like in this situation:

Are your beneficiaries correct on each of your financial accounts? If you are unsure, this is your reminder! Give us a call today to schedule a beneficiary check-up and explanation.

In a future article I will explain the pros and cons of having a trust listed as beneficiary, instead of individuals.

Ready to Plant the Seeds for Your Retirement?

You only get to retire once, but we help people do it every day. Whether you’re just starting to plan or are nearing retirement, the small choices you make today can have a big impact on your tomorrow.

Connect with us to see how a true partnership can help your financial life take root and thrive.